Introduction to Bitcoin Price GBP

As the world of cryptocurrency continues to evolve, many UK investors and financial enthusiasts are turning their attention to the Bitcoin price in GBP. Whether you’re a seasoned crypto trader or a curious newcomer, understanding the Bitcoin price GBP trends can be the key to making smarter decisions. In this guide, we’ll explore everything you need to know—from historical pricing to factors that influence fluctuations, and even tips on how to monitor real-time value efficiently.

What Is Bitcoin?

Before diving deep into Bitcoin price GBP, it’s important to understand what Bitcoin actually is. Created in 2009 by the mysterious figure known as Satoshi Nakamoto, Bitcoin is a decentralized digital currency that operates without a central bank or single administrator. It uses blockchain technology to ensure secure and transparent transactions, making it the first and most widely used cryptocurrency in the world.

Why Bitcoin Price in GBP Matters

The Bitcoin price GBP is especially important for UK investors. Most global platforms quote Bitcoin in USD, but for UK-based users, evaluating the price in British pounds helps in:

- Making more informed financial decisions

- Reducing currency conversion fees

- Understanding local tax implications

- Gaining better insight into purchasing power

For instance, if Bitcoin price in GBP is £45,000, that helps a UK buyer compare it directly to local investments like property, stocks, or ISAs.

Live Bitcoin Price GBP: How It Works

The Bitcoin price in GBP is determined by real-time market demand and supply across various exchanges. Prices are constantly updated, and even a single news item can cause massive fluctuations.

There are many platforms that offer live Bitcoin price GBP, such as:

- Coinbase

- Binance

- CoinMarketCap

- CryptoCompare

- eToro

These platforms use a combination of order books, trade histories, and liquidity to display real-time pricing data.

Historical Bitcoin Price GBP Trends

Understanding past Bitcoin price GBP movements helps investors gauge patterns and potential growth. Let’s take a look at a few key milestones:

| Year | Approx. Bitcoin Price in GBP |

|---|---|

| 2012 | £8 |

| 2017 | £14,000 |

| 2020 | £7,000 (pre-pandemic) |

| 2021 | £40,000+ (bull run) |

| 2022 | £13,000 (crash) |

| 2024 | £50,000+ (resurgence) |

These historical figures show just how volatile—and potentially profitable—Bitcoin can be. The Bitcoin price in GBP has seen dramatic ups and downs, reflecting both global economic conditions and crypto-specific events.

What Affects Bitcoin Price GBP?

Multiple factors contribute to the fluctuations in Bitcoin price GBP, including:

1. Global Market Sentiment

If there’s fear, uncertainty, or doubt (commonly known as FUD) in the crypto community, Bitcoin’s price drops.

2. Regulatory News

News from the UK’s Financial Conduct Authority (FCA) or global counterparts can influence local and international markets.

3. Supply and Demand

Bitcoin has a fixed supply of 21 million coins. As demand increases, so does the price.

4. Exchange Rates

The GBP/USD exchange rate can directly impact how the Bitcoin price GBP is calculated.

5. Institutional Investment

When big players like banks or hedge funds buy Bitcoin, it drives demand—and price—upward.

Tools to Track Bitcoin Price GBP

If you’re serious about crypto investing, tracking the Bitcoin price in GBP regularly is essential. Here are some reliable tools:

- TradingView: Offers real-time Bitcoin to GBP charts with technical analysis tools.

- Blockfolio / FTX App: Mobile-based price tracker.

- Google Finance / Yahoo Finance: Simple and accessible interfaces.

- Crypto ATMs in the UK: Some machines display current GBP conversion rates.

Many of these platforms also let you set price alerts for when Bitcoin hits your desired buy/sell level in GBP.

Is Bitcoin a Good Investment for UK Residents?

Investing in Bitcoin remains a speculative venture. However, it has outperformed many traditional assets in the past decade. Here are the pros and cons for UK investors:

✅ Pros:

- High potential returns

- Decentralized, borderless asset

- Hedge against inflation and fiat currency devaluation

- Growing mainstream acceptance

❌ Cons:

- High volatility

- Regulatory uncertainty

- Risk of losing funds due to hacking or poor storage

- Capital gains tax implications in the UK

Bitcoin price GBP should be just one of several metrics you analyze before making investment decisions.

Where Can You Buy Bitcoin in GBP?

Buying Bitcoin with GBP has never been easier. Trusted UK-friendly platforms include:

- Coinbase UK

- Binance UK

- Kraken

- Gemini

- Bitstamp

Most of these exchanges allow deposits via bank transfer (FPS), debit/credit card, or even PayPal. They also quote the Bitcoin price in GBP directly, making transactions more transparent.

How to Convert Bitcoin to GBP

Want to cash out? You can convert Bitcoin back to British pounds using the same platforms. The steps usually involve:

- Selling Bitcoin for GBP on your chosen exchange

- Withdrawing funds to your UK bank account

- Paying any applicable fees or taxes

Keep in mind that the Bitcoin price GBP at the time of conversion affects your final payout significantly.

Tips for Analyzing Bitcoin Price GBP

Here are some expert tips for analyzing and understanding the Bitcoin price in GBP:

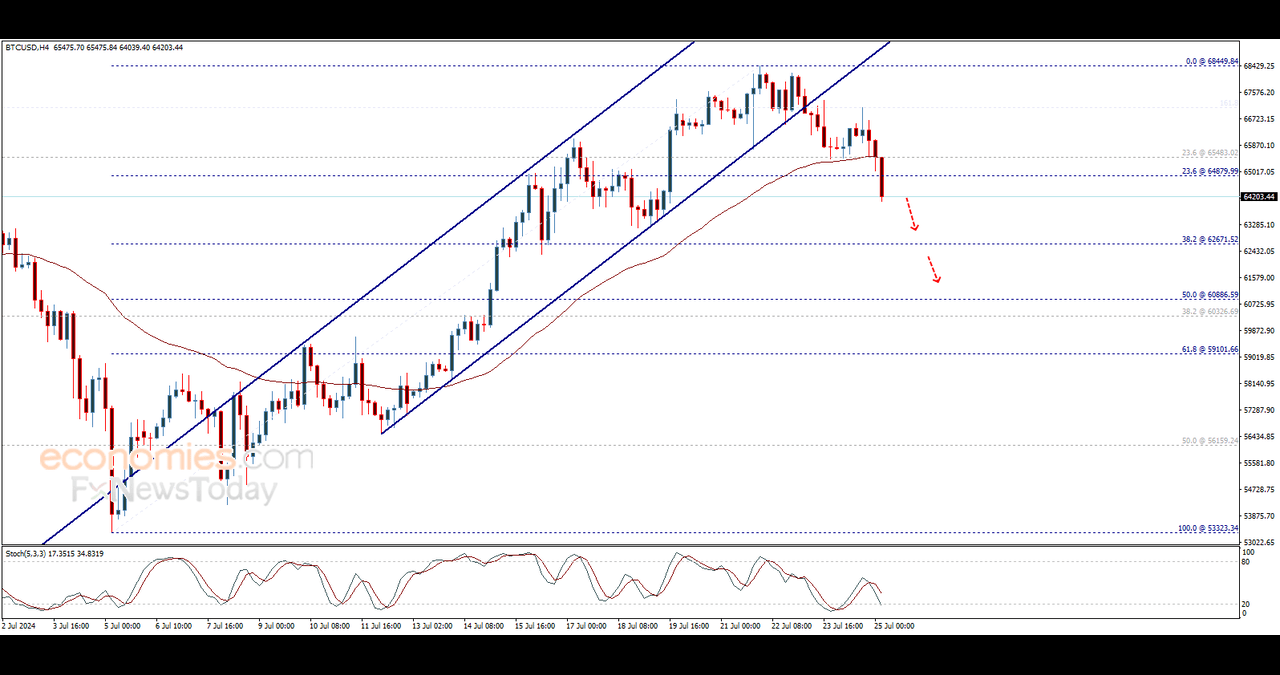

- Use candlestick charts for detailed technical analysis

- Combine GBP charts with USD to spot international trends

- Watch volume indicators to gauge market strength

- Follow UK-based crypto analysts for localized insights

- Check macroeconomic trends (interest rates, inflation)

Future Predictions for Bitcoin Price GBP

While no one can predict Bitcoin’s future with certainty, many analysts believe it will continue to grow. Factors like increasing adoption, ETF approvals, and fiat currency inflation could push the Bitcoin price in GBP to new highs.

Some speculative predictions for the next few years:

| Year | Estimated Bitcoin Price in GBP |

|---|---|

| 2025 | £70,000+ |

| 2030 | £150,000+ |

| 2040 | £300,000+ |

These projections assume continued adoption and stable regulations. But remember—crypto markets are extremely volatile.

Frequently Asked Questions (FAQs)

1. What is the current Bitcoin price in GBP?

The Bitcoin price in GBP fluctuates in real-time. You can check live updates on Coinbase, Binance, or TradingView.

2. Can I buy a fraction of Bitcoin with GBP?

Yes, Bitcoin is divisible up to 8 decimal places. You can buy as little as £10 worth of Bitcoin.

3. Is Bitcoin legal in the UK?

Yes, Bitcoin is legal and can be bought, sold, and held by UK residents. However, profits are subject to Capital Gains Tax.

4. How do I store Bitcoin securely in the UK?

You can store it in hardware wallets like Ledger or Trezor, or use trusted software wallets such as Trust Wallet or MetaMask.

5. Why is Bitcoin price in GBP different across platforms?

Slight variations occur due to exchange fees, liquidity, and real-time supply/demand differences.

Final Thoughts

Understanding the Bitcoin price GBP is crucial for anyone in the UK involved in crypto—whether you’re an investor, a trader, or just crypto-curious. By staying updated with reliable tools, analyzing trends, and knowing what affects the market, you can make informed decisions that align with your financial goals.

As Bitcoin continues to gain traction, its valuation in GBP will remain a topic of immense interest for years to come. So, keep watching, learning, and investing wisely.